Carbon Limit, a company that traps CO2 into cement, is GreenBiz’s Climate Tech Startup of 2023. The company stood out for its ambition to decarbonize construction, a sector known for its big contribution to greenhouse gas emissions.

Carbon Limit, which was awarded $20,000, beat out five other startups that pitched their businesses at our 11th annual VERGE Accelerate competition last week in San Jose, California. Thirty percent of the 523 climate and sustainability leaders in the audience voted that Carbon Limit had the best presentation and concept.

The other finalists were: BLIXT (energy storage maximization tech); Cascadia Seaweed (aquaculture tech); ElectricFish (a battery-integrated fast EV charger); Bedrock Energy (building decarbonization tech); and Intropic Materials (plastic degrading enzymes). These had been whittled down from 35 semifinalists, determined through an online vote of 121 applicants, which each represented one of six sectors: carbon; energy; food/agriculture; transport; buildings; and biodiversity.

But what separated the winner from the rest was its innovative solution. Carbon Limit, headquartered in Boca Raton, FL, focuses on capturing carbon dioxide from the air and storing it in cement and concrete, working to ultimately decarbonize the notoriously dirty industry sector.

Gabriel Kra, managing director of Prelude Ventures and Accelerate competition industry expert, explained why Carbon Limit’s strategy ultimately stood out: "Going after concrete and cement, that is a huge problem… It’s a tough business to win in, and so I was really excited to hear that pitch [from] that entrepreneur."

Intropic Materials, a startup that created enzymes to break down plastics, nabbed second place, with Bedrock Energy, a geothermal-based decarbonizing solution, securing third.

The what, why and where of Carbon Limit

"[My team and I] saw that concrete is one of the biggest polluters, and one of the biggest opportunities," Sperry told GreenBiz, "Behind water, it's the second most used material on the planet." Concrete production is estimated to contribute around 8 percent of global GHG emissions.

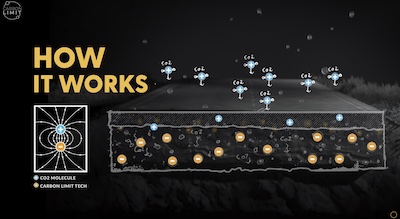

So Sperry created Carbon Limit and its premiere product, CaptureCrete. CaptureCrete is an additive that allows any concrete — from any company — to absorb and sequester carbon dioxide. CaptureCrete "is made up of active minerals that when added to concrete, allow it to attract CO2 like a magnet. In turn, the CO2 is permanently stored," said Sperry.

Image courtesy of Carbon Limit

But CaptureCrete wasn’t the original vision of Carbon Limit. "Carbon Limit started in TechStars Accelerator program as a direct air capture box," Sperry explained. "We were like, ‘Hey, we’ll capture some CO2 in this box and then we’ll put it into cement and sell it to concrete companies.’"

But, like many climate tech startups, Sperry quickly realized that his idea was anything but novel: "We were not understanding of the market, because [the products] we were selling were a dime a dozen. We found that our model wasn’t financially viable or interesting for investors."

So Sperry and Carbon Limit pivoted. Carbon capture technology that once depended upon a shipping container-like box to scrub CO2 out of the air and store it into concrete evolved into Carbon Limit in its current form.

"Our strategy is for larger cement and concrete companies to license our technology," Sperry clarified.

The companies that include CaptureCrete in their cement or concrete can then generate carbon credits, managed by Carbon Limit and accredited by forward-crediting platform Covalent. Any funds generated by the carbon credits are split between Carbon Limit and its customer.

Currently, Carbon Limit’s customers include Nebraska-based NCP Industries, the startup’s first official licensee. NCP produces a variety of concrete products for the commercial market.

Carbon Limit is also in conversation with another potential customer that Sperry was unable to disclose at the time of our interview. "We have one really large concrete producer that we are negotiating with in terms of a licensing agreement." He said to expect an update on the potential partnership in a week or two.

When asked to speak to Carbon Limit’s competitive landscape in the market, Sperry rejected the notion of competition entirely. "We see all of our competitors as partners." No company offers similar services or products as Carbon Limit, according to Sperry. Instead, Carbon Limit’s peers serve as a boon to overall impact. "You can actually stack [competitor’s] solutions with ours, inherently creating an additional positive impact that amplifies our technology. We can coexist."

To date, Carbon Limit has raised a total of $1.5 million from investors including HG Ventures and non-equity assistance from AcceliCITY powered by Leading Cities, with an additional $2 million in grants from the Department of Defense and US Army Corp of Engineers.